How companies prepared for mandatory climate reporting

How well did Australian companies prepare for mandatory climate-related disclosures under AASB S2 and assurance requirements?

Australian-listed companies faced a significant challenge in 2023 and 2024: preparing for the most significant change to corporate reporting in decades. With mandatory climate-related financial disclosures looming under AASB S2 Climate-related Disclosures and ASSA 5000 sustainability assurance standards, companies have scrambled to transform their reporting practices ahead of the requirements taking effect by the end of 2025.

For the first time, Australia’s largest companies will be legally required to disclose climate-related risks and opportunities, alongside their financial statements, with independent assurance required of this information by Registered Company Auditors. This represents a fundamental shift from voluntary sustainability reporting to mandated climate disclosures integrated into annual reports.

A recent stream of research, conducted by UNSW Business School’s Dr Jean You and Emeritus Professor Roger Simnett, both in the School of Accounting, Auditing and Taxation, reveals how ASX-listed entities prepared for this regulatory transformation. The stream examined annual reports from 2018 to 2024, tracking climate-related disclosures across all sectors and company sizes. The research employed systematic keyword searches across annual reports to identify climate-related content. The methodology involved searching for terms including "climate change," "greenhouse gas," "carbon emission," and "TCFD," followed by manual review to exclude non-relevant references. This comprehensive analysis exposed significant variations in preparedness levels and highlighted emerging best practices as companies navigated the transition.

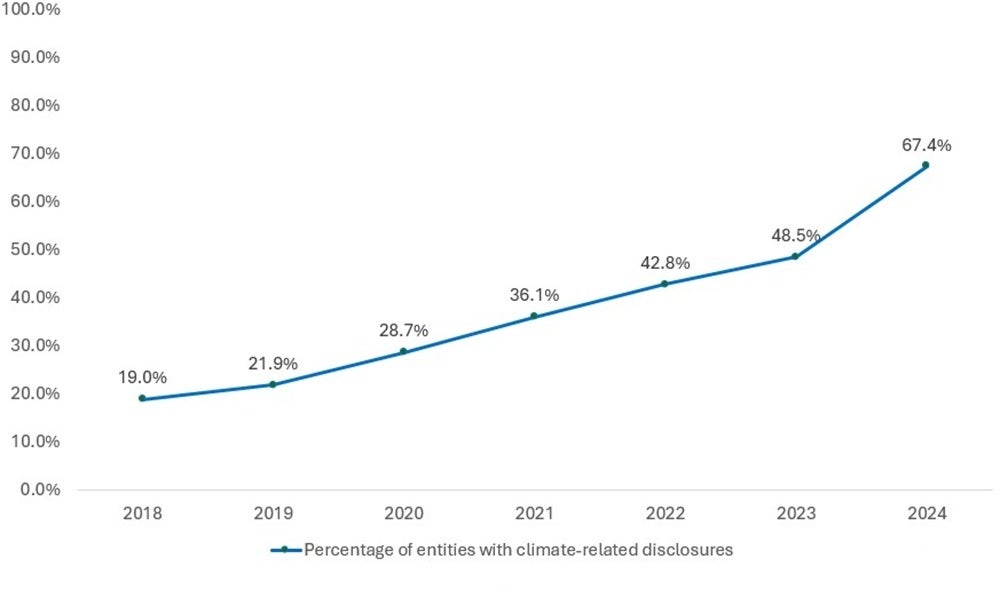

Australian-listed companies that include climate-related disclosures in annual reports

“While the research stream identified increasing trends in overall disclosures and assurance, and a high level of preparedness for entities whose mandatory reporting and assurance journey starts in 2025, it also reveals areas where the journey to mandatory reporting and assurance appears to be more problematic,” said Prof. Simnett, who also serves as a Professorial Research Fellow at the Integrated Reporting Centre in the Faculty of Business and Law at Deakin University. “This research also allows entities to evaluate their preparedness by facilitating a company’s benchmarking against other companies with similar characteristics.”

The compliance challenge emerges

The latest of the AASB-AUASB research reports, Preparedness of ASX-listed entities for climate-related reporting and assurance requirements: Trends in Annual Report Disclosures in 2023 and 2024, also co-authored with Research Associate Yi She and University of Sydney Associate Professor Shan Zhou, found there was a dramatic acceleration in climate reporting adoption. Overall disclosure rates surged from 48.4% in 2023 to 67.4% in 2024, demonstrating companies’ recognition that preparation was a journey that could not wait for mandatory deadlines.

Group 1 entities (Australia’s largest companies with consolidated revenue exceeding $500 million and meeting other thresholds) led the transformation. These organisations, facing the earliest compliance requirements (starting in 2025), achieved disclosure rates of 92% in 2024 (up from 89.9% in 2023).

The urgency became apparent when examining alignment with AASB S2 requirements. Companies referencing Australian Sustainability Reporting Standards or IFRS Sustainability Disclosure Standards increased from 12.6% in 2023 to 18.3% in 2024. More importantly, entities adopting the four-pillar reporting structure mandated by AASB S2 – covering governance, strategy, risk management, and metrics – grew from 7.9% to 12.7%.

Industry adaptation patterns

The more climate-sensitive industries maintained their leadership position, though all sectors demonstrated improvement. Real estate emerged as the standout performer, with disclosure rates jumping from 58.3% in 2023 to 93.6% in 2024 (the largest single-year increase among climate-sensitive industries). Utilities, traditionally strong climate reporters, reached 90% disclosure rates, consolidating their position as one of sector leaders.

However, the most remarkable transformation occurred in previously lagging industries. Health care companies increased disclosure rates by 70.8%, rising from 33.9% to 57.9%. Information technology firms similarly accelerated, improving from 37% to 55.9%. This broad-based adoption suggested that climate considerations had transcended traditional industry boundaries.

Learn more: Robert Kaplan on accounting's role in fixing climate disclosure challenges

The financial services sector was a notable anomaly, maintaining relatively modest disclosure rates at 49.2% despite being classified as climate sensitive. This reflected the sector’s unique challenges in quantifying climate risks across diverse portfolios and the complexity of downstream emission calculations.

Scenario analysis adoption remained limited but showed encouraging growth. Companies conducting climate scenario analysis increased from 7.1% to 11.7% of climate disclosers. Most analyses focused on global warming scenarios, with entities typically examining three scenarios, including 1.5°C and 2°C temperature increases aligned with Paris Agreement targets.

Financial integration progress

A critical indicator of preparation quality emerged in companies’ treatment of climate information within financial statements. Climate-related disclosures in notes to financial statements increased from 17.5% to 23.3% of climate-reporting entities, signalling growing recognition of the financial impacts and the potential connectivity of climate-related disclosures and financial reports.

The most common notes to financial statements containing climate information involved accounting policies, judgements, and basis of preparation, affecting 54% of relevant companies in 2024. This suggests that entities recognised climate factors as material considerations requiring disclosure in core financial reporting frameworks.

Executive remuneration structures increasingly incorporated climate metrics, with companies reporting climate-related incentives as part of these structures growing from 9.9% to 14.6%. More than half of these incentives related to carbon emissions reduction, though companies showed a trend toward more specific Scope 1, 2, and 3 emission targets rather than generic sustainability goals.

Group 1 entities led remuneration integration, with 32.9% incorporating climate factors into executive compensation in 2024. This represented a clear governance signal that climate performance had become a board-level priority directly linked to leadership accountability.

Assurance and accountability trends

Third-party assurance on climate information expanded significantly, though from a modest base. Companies referencing external climate assurance in their annual reports increased from 7.6% to 13.2%, while those including formal assurance reports grew from 2.4% to 4.2%.

The Big Four accounting firms dominated climate assurance provision, with 83% of assurance reports issued by companies’ incumbent financial auditors. Most engagements focused on Scope 1 and 2 greenhouse gas emissions, though Scope 3 coverage increased from 69.6% to 80% of assurance reports.

Learn more: Integrated thinking pays off: Strategic reporting's measurable impact

While limited assurance remained predominant, hybrid reports, which provided both limited and reasonable assurance, increased from 13% to 24%, indicating steps in the journey to the mandatory reasonable assurance requirements scheduled for 2030. Those areas on which reasonable assurance was provided were mainly the quantitative assessments of Scope 1 and 2 greenhouse gas emissions.

Climate considerations remained relatively rare in statutory audit reports, appearing in key audit matters for only 2.9% of companies. However, auditor references to climate information in other report sections increased from 0.7% to 2.2%, suggesting growing integration of climate factors into financial statement audits.

A climate reporting reality check from 2018-2022

Another part of the research stream, co-authored with Hazel Tan and Shan Zhou from University of Sydney, examined 7728 company-year observations spanning 2018 to 2022. Published in ABACUS, the study, Australian Listed Entities’ Preparedness for Mandatory Reporting and Assurance of Climate-related Disclosures, covered all ASX-listed entities, representing the first longitudinal analysis of climate reporting readiness across the entire Australian market.

The research team, who manually reviewed annual reports and conducted regression analyses to assess preparedness levels, found "an overall low, but significantly increasing, level of preparedness among Australian listed entities". Overall, only 30% of listed companies disclosed climate-related information in their annual reports at the time. While this improved from 19% in 2018 to 45% in 2022, the pace suggested many companies might struggle to meet approaching deadlines.

More concerning, only 24% of companies referenced the Task Force on Climate-related Financial Disclosures framework that underpins the new requirements contained in AASB S2, while just 7% structured their reporting using the recommended four-pillar approach covering governance, strategy, risk management, and metrics.

The research identified clear preparation patterns. Companies in carbon-intensive industries showed higher disclosure rates, reflecting greater exposure to climate risks and regulatory scrutiny. Those with Environmental, Social and Governance (ESG) committees performed better, highlighting governance structures’ crucial role. Companies audited by an auditor with greater expertise in climate-related industries (predominantly the Big Four firms in Australia) demonstrated higher preparedness levels.

The implementation costs associated with collecting and reporting mandatory climate-related financial information are significant. The Australian Treasury estimates that these costs exceed $1.3 million per entity for initial setup, plus ongoing annual costs above $700,000. These figures underscore the scale of change facing corporate Australia as climate reporting transitions from voluntary practice to mandatory compliance.

Subscribe to BusinessThink for the latest research, analysis and insights from UNSW Business School

“The insights provided by these types of research are invaluable. Many of the takeaways are common, especially for companies of similar size and sector. The more that can be learnt from others' experiences, and from identified best practices, the better the quality of information produced, and the lower the implementation costs should be,” said Prof. Simnett.

Key takeaways for business leaders

The research reveals four critical insights for business leaders navigating mandatory climate reporting requirements. First, early preparation provided a competitive advantage, with leading companies achieving smoother transitions and higher-quality disclosures through proactive adoption. The vast majority of companies that will be required to report and assure are Group 2 and 3 companies, with mandatory requirements starting in 2027 or 2028 respectively. Such companies should not wait until the last minute to start their journey to mandatory climate-related financial disclosures and assurance.

Second, integration rather than isolation emerged as the key success factor. The Australian regulatory approach is for companies to include a separate section in their Annual Report entitled “Sustainability Report”. However, companies that achieve best practice integrate climate considerations into financial statements, executive remuneration, and governance frameworks rather than treating sustainability reporting as a standalone activity.

Learn more: Green skills gap: upskilling for climate risk and reporting

Third, assurance quality mattered more than speed. Companies engaging their auditor early and investing in robust third-party assurance and comprehensive scope coverage, including Scope 3 emissions, positioned themselves better for mandatory requirements than those pursuing minimum compliance approaches.

“When following the mandatory climate-related reporting requirements, the companies should focus on insights into the business that reduce the information gap with stakeholders,” Dr You explained. “The annual reports with required climate-related information should be prepared with more connected reporting, rather than siloed reporting, to tell a holistic story of the business.”