How financial advice helps to deter financial crime

There are lesser-known benefits to having financial advisers in the community, like fewer cases of financial crime, a UNSW Business School study has found

The Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry revealed evidence of poor misconduct and criminal activities. The Commissioner attributed many issues to the financial advice industry’s cultural environment, governance arrangements, and remuneration structure and practices. As a result, the Royal Commission led to a significant crackdown on the education and ethics requirements and the profession’s remuneration structure. In the ensuing years, many advisers left the industry. Today, there are roughly 40 per cent fewer advisers on the Financial Advisers Register than before the Royal Commission.

Since the commission's findings were released publicly in 2019, the new requirements for professional advisers have certainly affected the financial planning industry. But, the decreasing number of financial advisers has also had wide-ranging effects on consumers. According to a UNSW Business School study, the locations with the least number of practising financial advisers have witnessed a noticeable increase in financial crime. The study, Unsung Guardians? Communal Fraud Susceptibility and complaints Following Mass Financial Adviser Attritions, is co-authored by Senior Lecturer Dr Natalie Yoon-na Oh and Professor of Finance Jerry Parwada from the School of Banking & Finance at UNSW Business School. 2021 University Medalist, UNSW Bachelor of Commerce (Honours) graduate Eugene Wang also contributed to the study, which has important implications for the industry, consumers and policymakers alike.

How many advisers have left the industry?

The study examines whether financial advisers have a lesser-known, broader contribution as disseminators of expertise to their wider communities. Indeed, the researchers argue the benefits of financial advice are often understated and that the exposure to professional financial acumen improves public awareness of deceitful financial schemes and reduces communal fraud susceptibility.

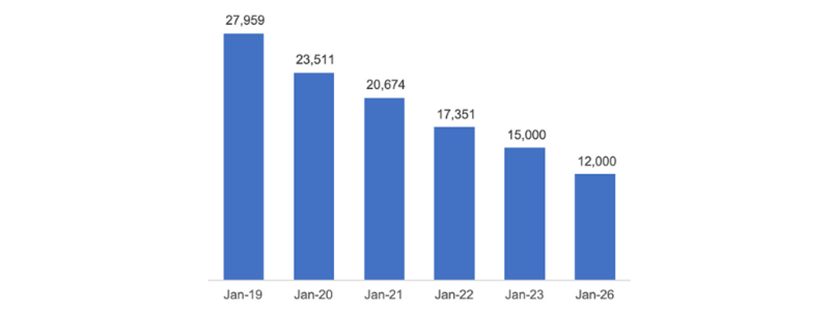

Referring to public data by Adviser Ratings, the study notes that adviser numbers have fallen by more than 10,000 since peaking at 28,000 in 2018. But this decline hasn’t yet run its full course, with Adviser Ratings predicting adviser numbers will continue to drop to 15,000 by 2023 and 12,000 in 2026. That’s a loss of 16,000 advisers, corresponding to over half of the profession (57 per cent) in just seven years.

Why have so many financial advisers left the industry? The unprecedented scale of adviser departures was triggered by the new educational and ethics requirements introduced in the Australian financial planning industry, explains Dr Oh. Specifically, this saw the removal of ‘grandfathering’ commissions and the introduction of continuous professional and ethics training, with bachelor’s degrees becoming the minimum required qualification.

“Since Financial Adviser Standards and Ethics Authority (FASEA) requirements were introduced on 1 January 2019, along with the final report of the 2018 Banking Royal Commission being released at the beginning of 2019, there has been an immediately noticeable drop in advisers, and the workforce peaking in 2018 at over 28,000 registered professionals, and it is expected to halve in the next few years,” Dr Oh says.

Adviser numbers

How does financial advice deter crime?

In the study, the authors find an 8.8 per cent increase in average fraud rates in local government areas that experienced above-median financial adviser departures over 2018 and 2019. In contrast, they find regions with proportionately more advisers with membership in professional associations register lower fraud cases. Interestingly, the authors add that higher education qualifications do not reduce financial crime pervasiveness or consumer complaints. This finding might be due to the requirement for higher academic qualifications being relatively new and not a strong attribute of those advisers who have left the industry. However, the authors conjecture this may change in the future as higher education qualifications become more pervasive.

With better practices, the evidence suggests that an increased presence of advisers will help boost financial literacy in communities, thus helping to deter financial criminals. “Increased ethics training among advisers has been shown to reduce crime by strengthening financial acumen within their surrounding populace. This may, in turn, improve an individual’s ability to discern whether their adviser’s investment recommendations are indeed beneficial for oneself,” says Dr Oh.

“Moreover, the inherent requirement for increased cost and time outlays to satisfy FASEA standards may reduce underperforming advisers. Hence, FASEA requirements may indirectly heighten industry quality, despite mandates for higher education having no direct evidence of improving adviser performance.”

Given the current predictions for diminishing advisers, the authors predict that financial crime will continue to increase until financial adviser numbers have recovered. They also noted that robo-advice is an inadequate substitute for advisers and cannot prevent DIY investors and communities from falling victim to scams in the same way that professional financial planners can. According to the authors, clients learn investment habits and knowledge from their advisers, who also act as a technical and emotional safety net for their clients.

Financial advisers as disseminators of financial literacy

While most people associate financial advice with making profitable investments, the services extend beyond that, says Prof. Parwada. “Financial advisers often provide a holistic review of clients’ financial and tax affairs when called upon. But more importantly, they may tailor their advice considering the individual client’s risk tolerance, such that it’s not all about making profit maximising investment choices,” he explains.

“In this regard, financial planners can provide a steadying, hold-your-hand type of influence on clients. Our research shows that at least part of the attrition in adviser numbers can be regarded as a correction of previous excesses in the industry. Anecdotal evidence also shows a general improvement in the quality of service in the industry,” says Prof. Parwada.

“However, other institutional factors have also had a significant impact that should not be discounted. For example, the reconfiguration of the ownership structure of advice groups from the previously perversive vertically integrated model dominated by big banks has also led to less conflicted adviser employment arrangements at the practice level,” he says.

“Continuing on the path of professionalisation, especially raising provider credentials such as education and practical experience requirements, is a must for improving consumer trust. This is a well-tested approach to building trust in human-capital intensive professions such as health and allied services. Wealth management is not an exception,” concludes Prof. Parwada.

Professor Jerry Parwada is a Director of Academic Strategy in the School of Banking & Finance at UNSW Business School and a Visiting Scholar at the Stern School of Business, New York University. Dr Natalie Yoon-na Oh is a Senior Lecturer in the School of Banking & Finance at UNSW Business School.