The seven biggest risk factors affecting global financial stability

Global financial stability is influenced by factors including regulatory frameworks, systemic risks and other emerging challenges, writes Professor Fariborz Moshirian

In an increasingly interconnected global economy, global financial stability and the presence of a resilient and sound global financial system are considered global public goods. Any expected and/or unexpected risks that threaten the global financial system could potentially lead to systemic risks, major disruptions and even possibly to global financial crisis.

For instance, the world observed in 2008 how the collapse of Lehman Brothers, one of the major US investment banks, triggered systemic risks and destabilised the financial market. This has led to strong intervention by the US Federal Reserve and, subsequently, intervention also by other central banks and regulators around the world within the G20 Forum.

Strengthening checks and balances

However, since the global financial crisis, major central banks and regulators around the world including the Bank for International Settlements have introduced a number of policies and measures as a way of mitigating either the next potential global financial crisis and/or preventing the associated adverse consequences on individuals, business and the economy. Yet, from time to time, a major financial interruption/shock occurs from a direction that is often unexpected.

The collapse of Silicon Valley Bank (SVB) and a few other regional banks in the US in 2023, and to some extent, the collapse of Credit Suisse, and its subsequent purchase by UBS, in Switzerland have reminded policymakers and regulators that they should remain vigilant in the way both national and global banking systems are supervised and coordinated.

There is no doubt that the global banking system is now far more resilient than prior to the global financial crisis. Policy makers and regulators have undertaken a number of measures to address the weaknesses of some of the regulatory tools and measures and have also introduced new ones. These measures have also enabled both financial institutions and the global financial system as a whole to handle the negative impacts of COVID-19 much better.

Banks that are too big to fail

Some of these regulatory undertakings, led by the Bank for International Settlements, include building resilient financial institutions (by introducing Basel III including prescribing that banks increase their capital requirements), categorising 29 large multinational banks under “systemically important financial institutions” (i.e. too big to fail) and requiring them to put aside more capital and undertake other regulatory measures as a way of ensuring adequate funds in the wake of any potential bank run and other related issues in the future.

Agricultural Bank of China

Bank of America

Bank of China

Bank of Communications

The Bank of New York Mellon

Barclays

BNP Paribas

Construction Bank

Citigroup Inc.

Deutsche Bank AG

Goldman Sachs

Groupe BPCE

Groupe Crédit Agricole

HSBC Holdings plc

Industrial and Commercial Bank of China Limited

ING Group

JPMorgan Chase

Mitsubishi UFJ Financial Group, Inc

Mizuho Financial Group, Inc.

Morgan Stanley

Royal Bank of Canada

Banco Santander, S.A.

Société Générale S.A.

Standard Chartered plc

State Street

Sumitomo Mitsui Banking Corporation Group

Toronto-Dominion Bank

UBS Group AG

Wells Fargo

Basel III endgame is the last step to ensure that banks with over $100 billion in assets have adequate capital reserves in the wake of a potential major loss. It is expected, at this stage, that banks should start complying with the rules of Basel III endgame from June 2025, with the view of having them fully operational three years later. Some of the other measures include ensuring effective resolution regimes and policies, more effective supervision and making the derivatives market safer.

Risks to global financial stability

Despite the current measures to ensure global financial stability, in an interconnected world, there are potential risks that could disrupt the smooth functioning of the global financial system.

Sovereign debt: One risk is the very high level of sovereign debt accumulated by developing countries and the burden of servicing these debts, particularly when some of these countries have undergone slow economic recovery since the COVID-19 pandemic. Similarly, the size of the US budget deficit is a major concern for the IMF and others, as the potential risk associated with it could have a major impact on the global economy and global financial stability.

Read more: Calculating risk and return in the new world of sovereign debt

Sophisticated cyberattacks: The IMF has warned that global financial stability could be under threat from increasingly sophisticated cyberattacks. Multinational banks could be vulnerable as a major cyberattack could potentially lead to funding challenges and possibly to the insolvency of one or a few large banks. The potential absence of resilience against cybersecurity attacks could also undermine confidence in the current global financial system.

However, it is too speculative to argue that if one of the systemically important financial institutions becomes insolvent, it will automatically lead to systemic risk and major disruptions of the entire global financial system.

Climate change: The climate change crisis has contributed to bushfires and flooding, resulting in damage to and destruction of major infrastructure, businesses and homes. Over time, the cost of adapting to climate risk that involves rebuilding (plus the likely rise of insurance premiums) could make business activities less profitable. The balance sheets of banks could be affected by some of their clients, who may potentially default due to loss of assets and/or income, not to mention the negative economic impact of gradually rising sea levels along some of the coastal areas.

It is not surprising that, in recent years, some of the major central banks, including the Reserve Bank of Australia, have been considering the impact of climate risk on various aspects of the economy, including the resilience of financial institutions and the banking system. Such additional risk factors need to be considered as part of ensuring the resilience and stability of both national and global financial systems.

Money market funds: Despite tight regulations of banks, money market funds are not fully regulated, according to a study published by the US Federal Reserve Board. These institutions manage over US$9 trillion in financial assets around the world. In the past, in different parts of the world, we have observed money market runs (i.e. people rushing to withdraw their money from banks all at once). There is a call by the US Federal Reserve and others to reform this important and large sector of the financial system, as there is a significant spillover of risk from money market funds to financial institutions and the entire financial system.

Private equity firms: Private equity firms with total assets of up to $8 trillion – consisting of many assets ranging from supermarkets and airports to smaller assets – could potentially be another source of global risk as their business model and the way they finance their activities (i.e. debt, particularly during the time when interest rates were very low) could potentially tangle some large bank in debt and create major challenges for them.

Learn more: The Institute of Global Finance

Artificial intelligence: Another source of risk to the stability of the global financial system is artificial intelligence (AI). US Securities and Exchange Commission Chair Gary Gensler reportedly stated that the next financial crisis could emerge from firms’ use of AI.

Financial institutions have started to use AI for a number of purposes including compliance work. Increasingly, banks are relying more heavily on generative AI technology for collecting and aggregating data. However, if such a new approach is not well complemented by careful scrutiny, it has, according to Mr Gensler, potential for systemic risk for banks. It is not surprising to note that Sam Altman, the chief executive of OpenAI, “called on Congress to create licensing and safety standards for advanced AI” as lawmakers began a bipartisan regulatory undertaking.

Global geopolitical tension: The recent increases in global geopolitical tension have had negative impacts on business activities, including for multinational banks. During his visit to China in 2023, JPMorganChase CEO, Jamie Dimon, stated that “Tensions between the US and China have upended the international order, making it more complex for business to deal with than during the Cold War.”

Geopolitical tension and financial fragmentation could have a number of consequences for global financial stability. One such consequence could lead to financial restrictions, increases in cross-border credit and investment outflows, as explained by the IMF, leading to an increase in banks’ debt rollover risk and hence funding costs. Similar to the impact of the European sovereign debt crisis on government bonds within the Euro-zone, global and/or regional geopolitical tensions could increase interest rates on government bonds. This, in turn, could negatively affect the balance sheet and asset values of systemically important financial institutions affected by geopolitical tension. This could lead to an increase in banks’ funding costs and credit risk.

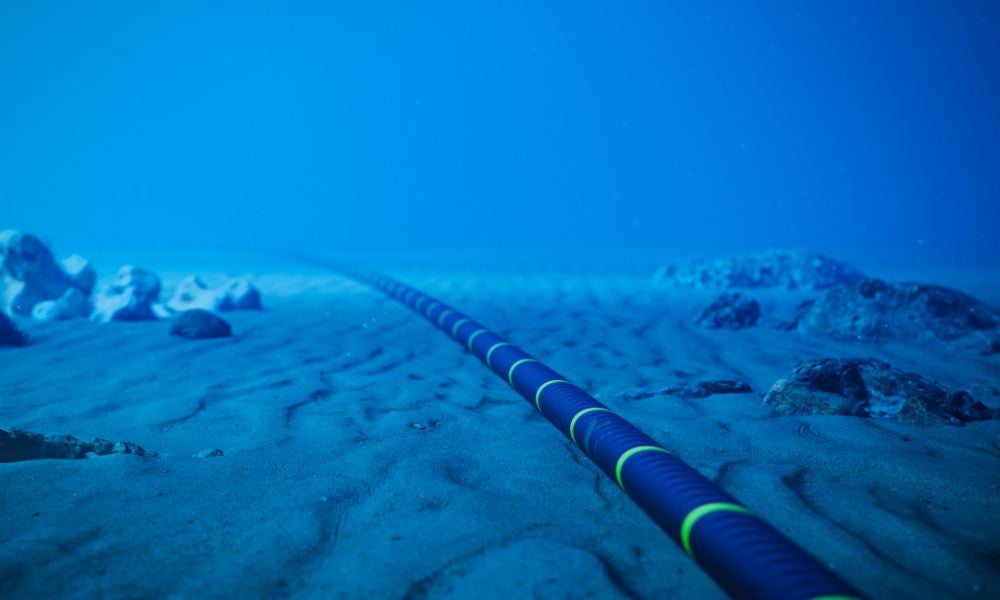

The global traffic of two major payment systems, SWIFT and CHIPS, which facilitate the process of over $10 trillion in financial transfers daily, is mainly carried out via subsea cables. One way that these subsea cables could be damaged and lead to possible major global financial interruptions is through sabotage initiated due to geopolitical tensions amongst some of the major countries.

Financial crisis lessons from the past

The history of financial crises over the past 200-plus years has taught banks and non-banks alike to be prepared to adjust their financial activities and that large financial liquidity shocks may well occur in the future (ie, it is a matter of when and not if) that they have to be prepared for. Further, unexpected events could generate systemic risk and disrupt national and/or global financial systems.

Subscribe to BusinessThink for the latest research, analysis and insights from UNSW Business School

However, due to a far greater level of interconnectivity in the global financial system since 2008, the impact and consequences of any major global disruption that could lead to global systemic risk and possibly to global financial crisis could be far more consequential and more costly than the one this generation observed in 2008.

Professor Fariborz Moshirian is the Director of the Institute of Global Finance (IGF) and an AGSM Scholar at the UNSW Business School.