Impact investing in Australia: What investors need to know in 2026

Australia’s $157 billion impact investing market is set to keep growing into 2026, as investors embed impact more deeply while addressing key long-term challenges

Impact investing is at a pivotal moment globally. As political backlash against green finance intensifies in parts of the US, global attention is turning to whether sustainable and impact-focused investments can maintain momentum.

Research published last year showed that Australia’s impact investing market has grown to more than $157 billion, now invested across impact products, with high levels of investor satisfaction, driven by strong demand for environmental, social, and sustainable investment products. The findings come from a landmark report by Impact Investing Australia and the UNSW Centre for Social Impact, which provides the most comprehensive and current analysis of the sector, examining investor attitudes, capital flows, and the range of available products.

The Benchmarking Impact: Australian Impact Investor Insights, Activity and Performance Report 2025 showed that capital flowing into impact investing has significantly exceeded market expectations. The research surveyed active and prospective investors representing more than $345 billion in funds under management and analysed 197 publicly available impact investment products.

“This report provides the first detailed analysis of the Australian impact investing market in five years,” said Impact Investing Australia CEO David Hetherington. “We can now confidently say that impact investments are delivering on their promise of generating both a positive, measurable impact and a competitive financial return – but Australia’s impact investing market remains underdeveloped relative to its peers.

“Federal leadership in establishing a wholesale co-funding mechanism that provides cornerstone investment alongside private and philanthropic capital would accelerate a deeper, more efficient impact investing market. This would deliver long-term productivity gains by unlocking significantly greater private investment in areas like inclusive employment, affordable housing and regional development.”

Australian impact investing market growth

This rapid growth matters. Impact investing plays a critical role in financing climate solutions, managing long-term financial risk, and supporting a resilient, future-ready economy – making its trajectory and positive impact highly significant for investors, policymakers, and businesses alike.

The Australian impact investing market comprises approximately $12.5 billion in impact funds – primarily private equity, infrastructure, and debt – and $145 billion in green, social, and sustainability bonds, largely issued by semi-government entities.

The report’s findings show that some 80% of investors report that financial performance has met or exceeded expectations, while 84% say impact outcomes have done the same. In addition, about three-quarters of investors say they use impact measurement and management practices and frameworks, like the Sustainable Development Goals, and almost 90% of respondents say they believe more decisive Australian government action will be critical to sustaining future growth.

Learn more: CSI’s Danielle Logue on how to best invest for social impact

Leading UNSW researchers, Professor Danielle Logue, Associate Professor Melissa Edwards, Dr Yi Zhao and Michelle Cripps partnered with Impact Investing Australia to build the national survey and analysis of product screening.

Reflecting on what surprised her most in the findings, A/Prof. Edwards, co-author and researcher at the Centre for Social Impact, says: “The overall growth in funds and bonds which met and exceeded both market expectations, and investors’ self-reported financial and impact performance, since last reporting in 2020. The product screen uncovered a publicly available impact product set almost twice as large by volume and eight times as large by value compared with five years ago.”

The report also includes case studies from not-for-profit organisations and impact investment practitioners, showing how impact investment funds and blended finance structures are supporting social and environmental outcomes in Australia, including First Nations initiatives that back Indigenous-led enterprises and economic participation through culturally informed capital.

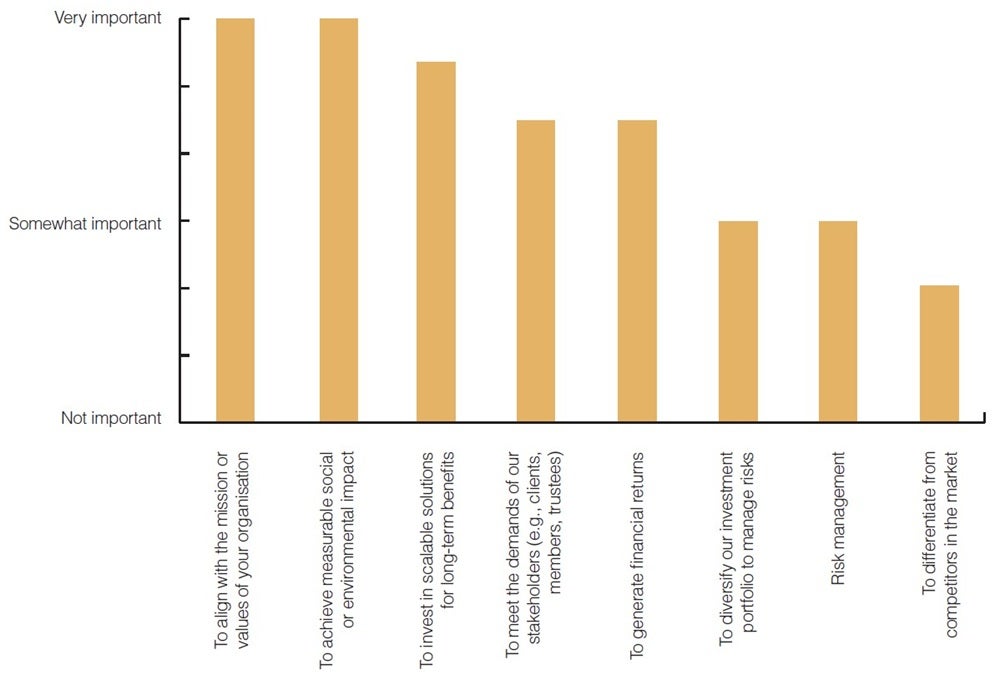

What is driving the shift toward social impact investments?

Prof. Danielle Logue says global climate and policy dynamics are central to shaping investor behaviour when choosing between different asset classes.

She explains: “Global trends in climate-related finance, alongside Australia’s policy and market shift toward net zero, are increasingly linked to the financial performance of investments that reduce greenhouse gas emissions, lower carbon footprints, and support the generation, acquisition, and transmission of clean energy.”

She says this is increasingly being matched by a broader understanding of social value. “We can see this coupled with a shift toward social impact investing where environmental impact and climate-focused products can now be distinguished by their social co-benefits, particularly through the use of sustainability-linked and social bonds.”

This convergence is especially visible in renewable energy and housing. “For example, in renewable energy projects, a just transition approach can be prioritised. This means delivering emissions reductions or improved energy productivity while also ensuring that clan energy technologies and infrastructures create tangible social benefits, such as local employment, capability development, and reinvestment of profits into place-based community development.

“Similarly, investments in affordable and social housing aim not only to meet sustainability standards, such as 5-Star Green Star ratings, but also to support tenant satisfaction, housing stability, and the creation of liveable communities.”

Will impact investing continue to grow?

The report finds that 60% of investors believe impact investments are likely to deliver financial returns at or above market rates in the future. But what about the impact of rising complexity and some global resistance?

Dr Yi Zhao, also a researcher at the Centre for Social Impact and author of the report, says this tension is shaping how quickly impact investing can become mainstream. “While 90% of survey respondents expected that impact investing will become an integral part of their investing strategy in the future, we see a current backlash against impact investing globally, especially because of a lack of agreed definitions and impact performance standards for assessing the real-world effects of impact, ex-ante.

“Given this, it is difficult to see it becoming mainstream, but we might anticipate a more general acceptance of impact investing as part of an investment strategy.”

At the same time, many Australian investors are already embedding impact much more deeply. “Of the active impact investors surveyed, about half took an integrated approach, where they apply an impact lens across their entire portfolio, suggesting this is far more core to their investment strategy than supplementary or niche.”

Barriers to continued growth in impact investing

According to the report, transparency, impact measurement, and operational complexity remain key barriers to sustained growth in the sector.

“Despite there being a genuine commitment to impact investing, there was a general sense that the complicated administrative burden and/or assuring performance ex-ante was limiting their own capacity to structure and manage deals," said Prof. Logue. "This is further complicated by the diverse array of frameworks and metrics in use, and with approximately a third of the sample relying on proprietary methods and a quarter not disclosing their impact via reporting.”

The research also points to limited global engagement. “Generally, despite the overall increase in impact investing in Australia, there was very little interest (just 4%) in investing in emerging markets, with a further 38% indicating they were uninterested.”

Subscribe to BusinessThink for the latest research, analysis and insights from UNSW Business School

Barriers in emerging markets also vary by role. Active investors most often cited limited market demand and internal constraints, such as mandate restrictions and a lack of expertise, while advisers focused on external risks, including political, regulatory, and currency uncertainties. Despite interest in regions such as Asia and the Pacific, engagement remains constrained by a mix of organisational, risk, and market readiness factors.

The results also highlighted several other practical challenges. Dr Zhao noted: “Survey respondents cited resource constraints, a lack of reliable or comparable data, an absence of standard frameworks and measures, or little alignment or engagement from stakeholders as significant barriers to improved impact measurement and management.”

There was also broad agreement that government intervention is needed to unlock further growth. “There was general consensus across advisors and investors that more government support was needed – including in providing tax incentives, creating a wholesale ‘fund of funds’ to capitalise impact-driven investment vehicles and creating education programs to build the capacity of both current and future market participants.”

Impact investing trends to watch in 2026

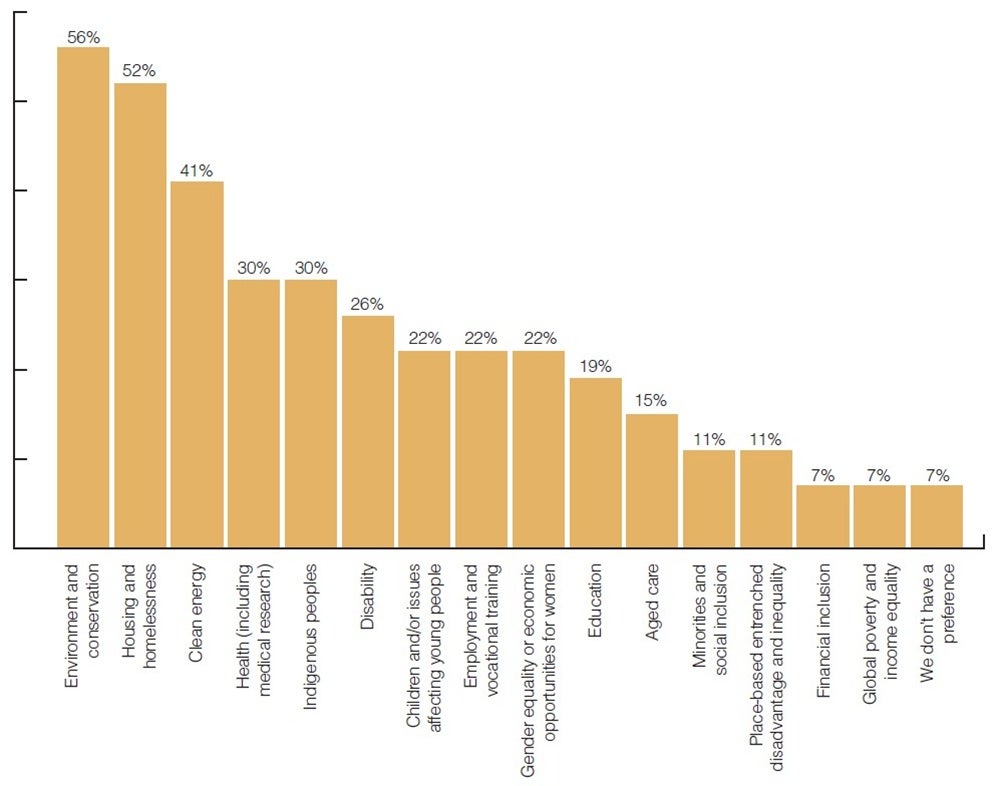

Looking ahead, A/Prof. Edwards expects investments that address environmental issues, climate change, and affordable housing to continue dominating Australia’s impact investing market. She says the findings show the sector remains primarily driven by an increasing need for social services, with investors most commonly focused on environmental and conservation issues, housing and homelessness, and clean energy initiatives. Social issues such as affordable housing, inequality, decent work, health, and inclusive communities are more visible when impact is assessed through broader frameworks such as the SDGs.

This imbalance is most evident in the bond market, where environmental outcomes dominate, and only a small share of products focus exclusively on social impact. While impact funds show a more even split, the research suggests that social outcomes – including disability, gender equality, employment, and youth issues – remain underrepresented, a gap that future editions of the report will monitor closely.

Looking ahead, Prof. Logue said that pressure on investors and businesses to demonstrate real-world impact is also expected to intensify. “Given the critiques, we can anticipate continued critique on the role of impact investing in addressing intractable social issues and the deployment of capital to emerging and developing economies.”

The current pattern may reflect a shift rather than a shortcoming. “Our survey and the product shows that Australian impact investors are far less focused only on social issues as these are not the major current focus of impact funds (with their main focus on climate action and sustainable cities and communities), even though survey respondents self-report a high priority focus on reducing inequalities, decent work and economic growth, sustainable cities and communities and health," said Prof. Logue.

“Or this may be a welcome sign of the movement toward more integrated means for assessing impact which focus across thematics, rather than on sole issues.”

For more information, download the full report: Benchmarking Impact: Australian Impact Investor Insights, Activity and Performance Report 2025.