Three useful things to know about Bitcoin risk, returns and diversification

Bitcoin has a number of risk and return characteristics, and investors need to factor in a number of important considerations when adding Bitcoin to a diversified portfolio, writes UNSW Business School's Mark Humphery-Jenner

Investors are increasingly considering including Bitcoin in their portfolios. Kevin O’Leary – of Shark Tank fame – has indicated Bitcoin could constitute up to 5 per cent of his portfolio. In Australia, Mark Carnegie has indicated he would launch an unlisted crypto fund and that investors should consider allocating 1 to 2 per cent of their net worth to cryptocurrencies.

The cryptocurrency investment thesis rests on several assumptions: crypto must either (a) offer additional diversification benefits, and/or (b) perform at least as well as other asset classes on a risk-adjusted basis. Let’s examine this in more detail.

We will start by analysing Bitcoin’s risk and return characteristics. It will then discuss the arguments surrounding adding Bitcoin to a diversified portfolio. Naturally, this is moot if you believe that Bitcoin is overpriced and is destined to yield negative returns over the long term.

1. Bitcoin (and cryptocurrency) return and risk

Let us start by looking at the basics of Bitcoin’s risk and return. Two main types of risk are relevant: (1) The risk inherent in Bitcoin’s returns per se, and (2) the risk of measurement error when estimating those risks.

Tautologically, we can only look at historical data. Past performance and risk are informative. But, future performance and risk can differ. This is especially a concern with Bitcoin, which has experienced both significant volatility in both the level and variance of its daily returns. This means that model risk is important.

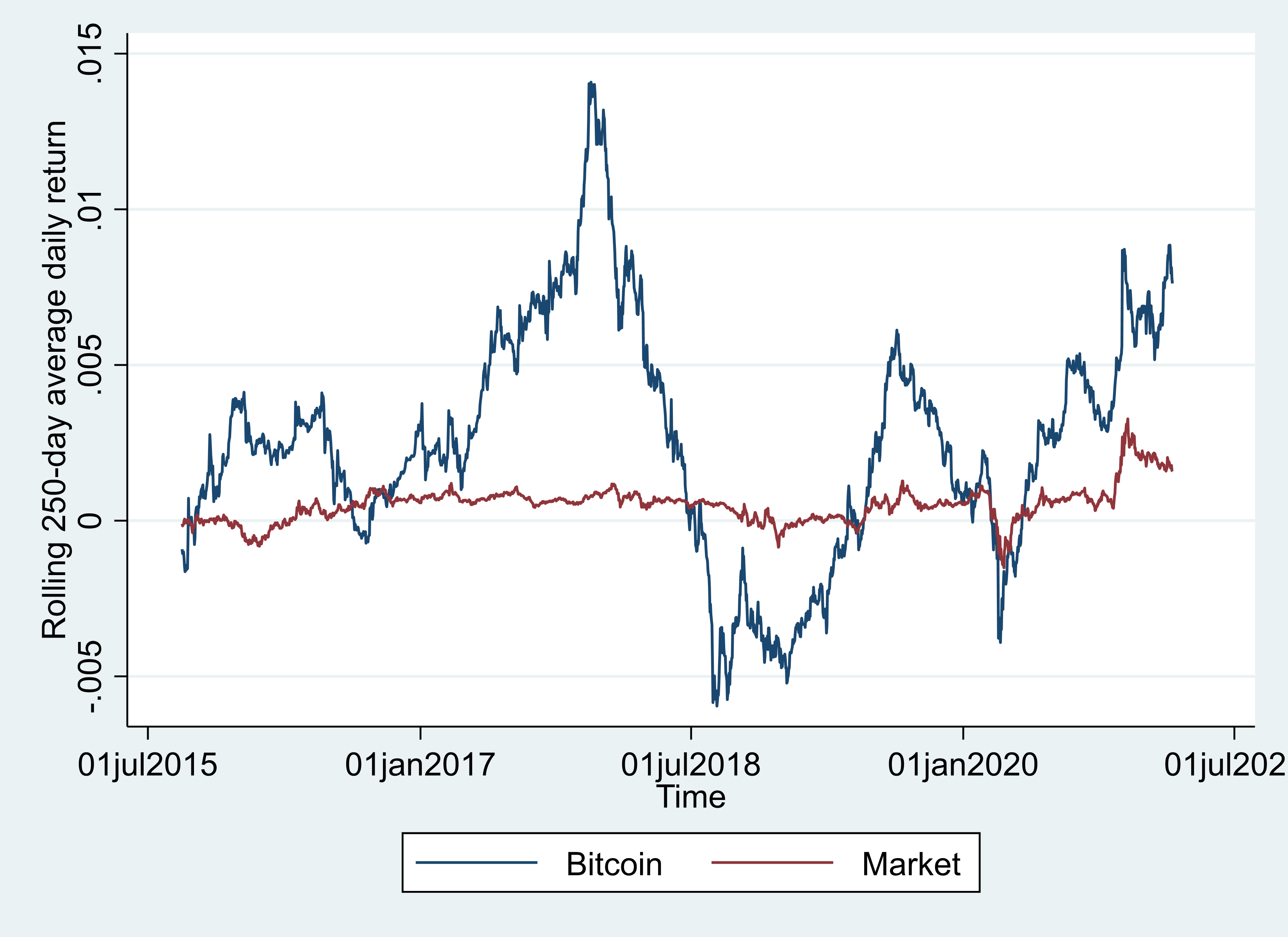

Bitcoin’s price can oscillate wildly. Within April 2021, it has swung been between $63,000 and $50,000. The annualised standard deviation of daily returns is 67 per cent. But, this fluctuates over time. Figure 1 shows that the 250-day average return fluctuates significantly over time. This suggests significant volatility in Bitcoin’s average performance. However, for significant periods, Bitcoin has earned a higher average return than has the market.

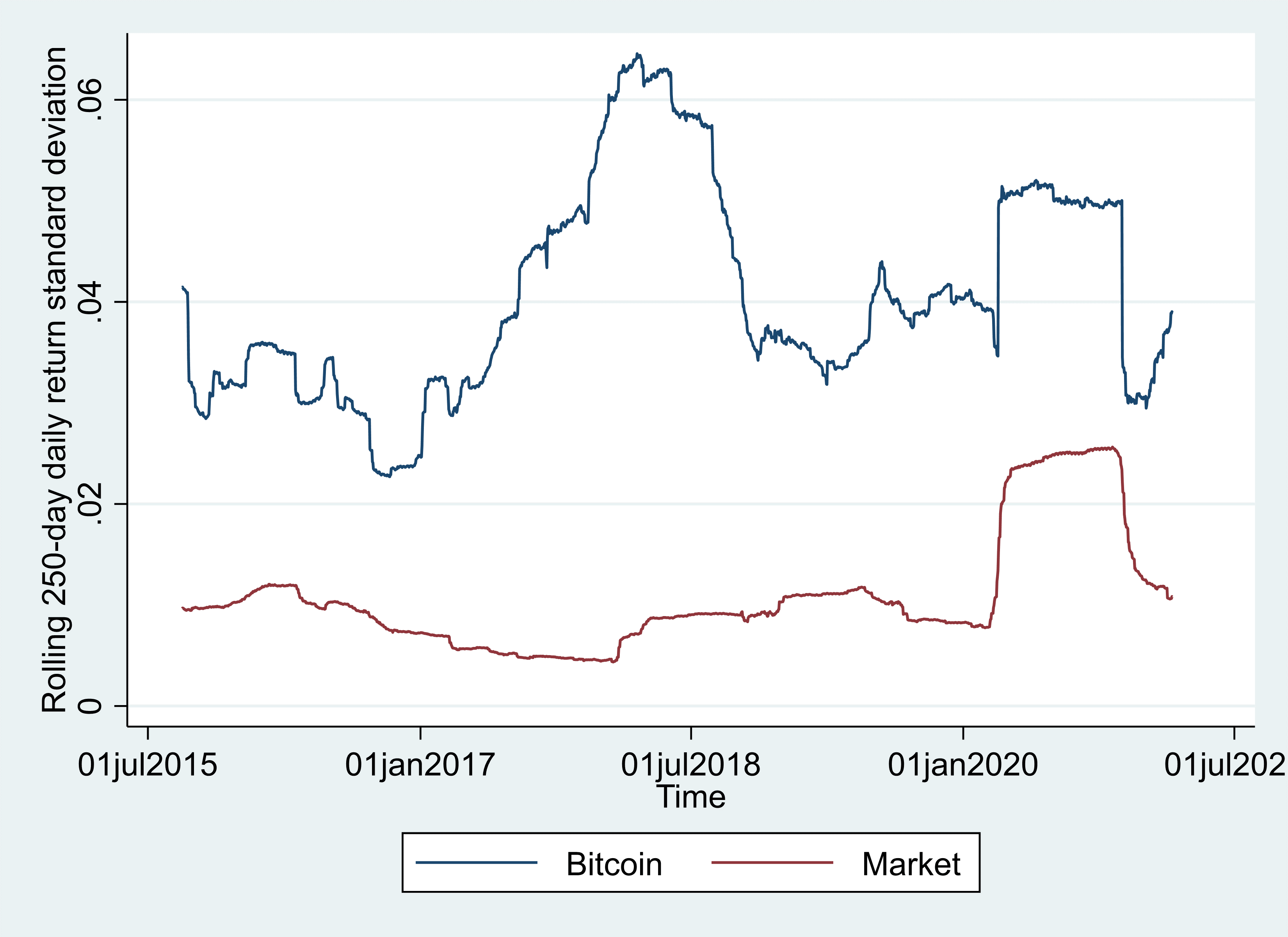

Bitcoin’s volatility is itself volatile. We can capture this by analysing Bitcoin’s standard deviation of daily returns. Analysing the rolling 250-day standard deviation of daily log returns, again, the standard deviation fluctuates significantly over time. This makes it difficult to predict how risky (or not) is bitcoin. The standard deviation of returns is only one of many risk measures. However, it does indicate the significant risk inherent in Bitcoin. In all periods, Bitcoin has a higher standard deviation than does the market index.

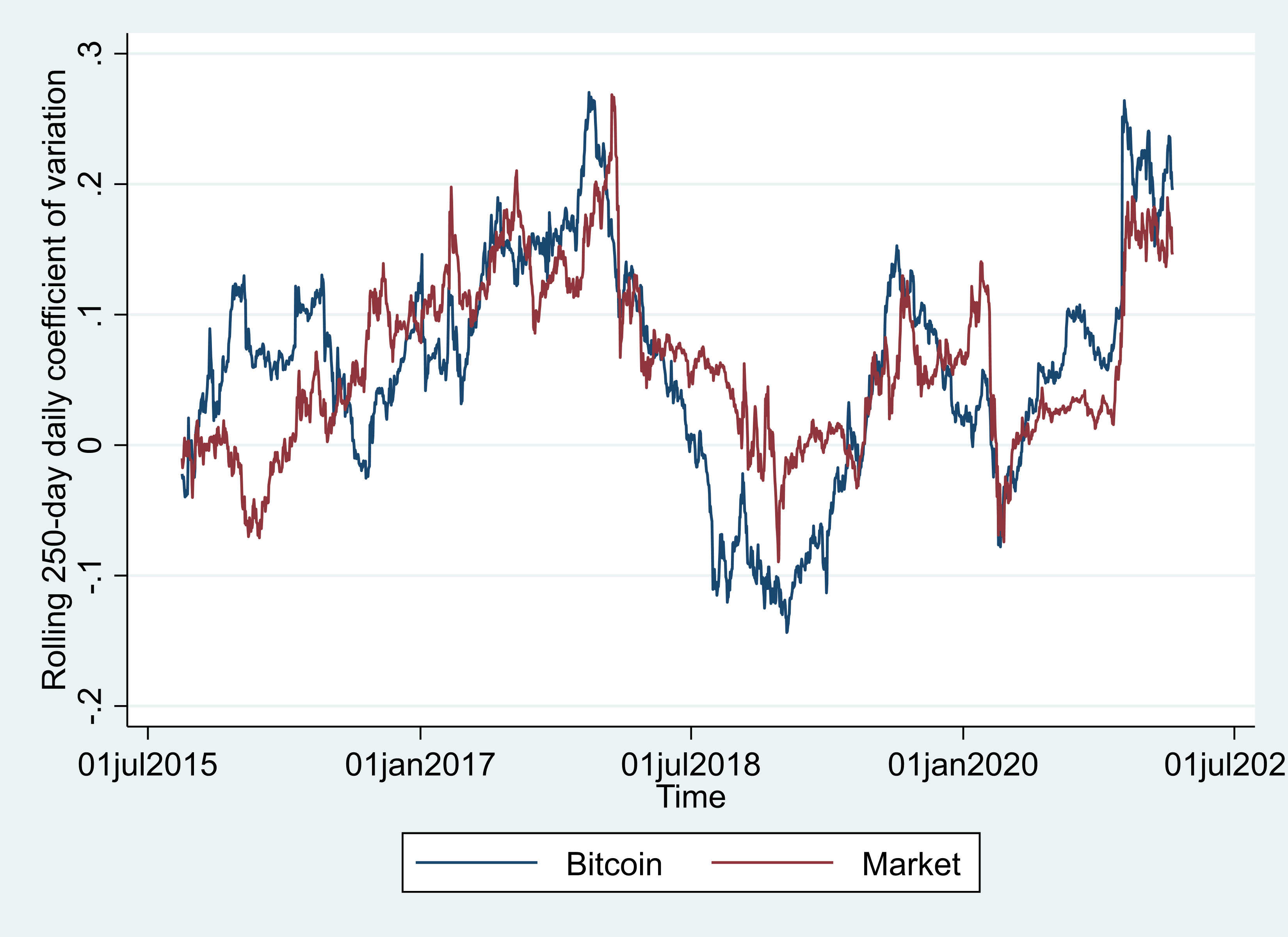

We can capture the return per unit of risk by looking at the coefficient of variation. This is also volatile. Bitcoin’s coefficient of variation is higher than that of the market, on average. It has had a higher coefficient of variation than has the market. However, this is not always the case. Figure 3 plots that coefficient of variation. It indicates that Bitcoin’s coefficient of variation has a similar pattern to that of the market, and is not always above that of the market.

When we put this information together we see that Bitcoin is risky. The returns are volatile. The average return – which could smooth that volatility – is also volatile. The estimates of volatility are volatile. Thus, Bitcoin is riskier than the broader market, both in terms of its historical performance and in terms of our ability to predict future risk and returns.

2. Could bitcoin still provide diversification benefits?

How to assess diversification benefits. The next issue when considering adding cryptocurrency to a portfolio is whether it conveys a diversification benefit. Diversification enables investors to earn a higher return per unit of risk. This arises because assets have two main types of risk: systematic risk and idiosyncratic risk.

Idiosyncratic risk connotes the random movements that are inherent to the asset’s own characteristics. For example, for a firm, an idiosyncratic risk is the risk of a factory randomly burning down, or the CEO suddenly having a heart attack.

Systematic risk connotes risk associated with the asset’s correlation with other market-wide factors. For example, interest rate changes impact the whole market. The asset’s systematic risk is then the asset’s sensitivity to this impact. It is usually measured by the asset’s “beta” with respect to the market index. The beta reflects the sensitivity and responsiveness of the asset’s returns to returns on the market index.

Systematic risk can be further analysed through factor models. Factor models posit that there are multiple systematic factors that can impact returns. These factors have a risk premium associated with them. For example, small firms sometimes perform better (or worse) than large firms. Similarly ex-ante highly valued firms, or positive momentum firms. If the asset’s returns merely reflect the returns to those factors, it would suggest the asset could simply be replicated with a properly constructed portfolio.

Bitcoin’s diversification benefits? Let us start by looking at the most straightforward measure of Bitcoin’s diversification benefits, or lack thereof: its beta (β), alpha (α) and the R-squared from the model estimating the alpha and beta.

In technical terms, one obtains the beta by estimating the regression model r(btc,t) = α + βr(mkt,t) + ε, where r(btc,t) is the return that Bitcoin earns on day t and r(mkt,t) is the market index return on day t. The terms α and β are the regression intercept and slope coefficient, respectively, and ε represents the residual.

Read more: What Tesla’s $1.5 billion bet on Bitcoin means for crypto legitimacy

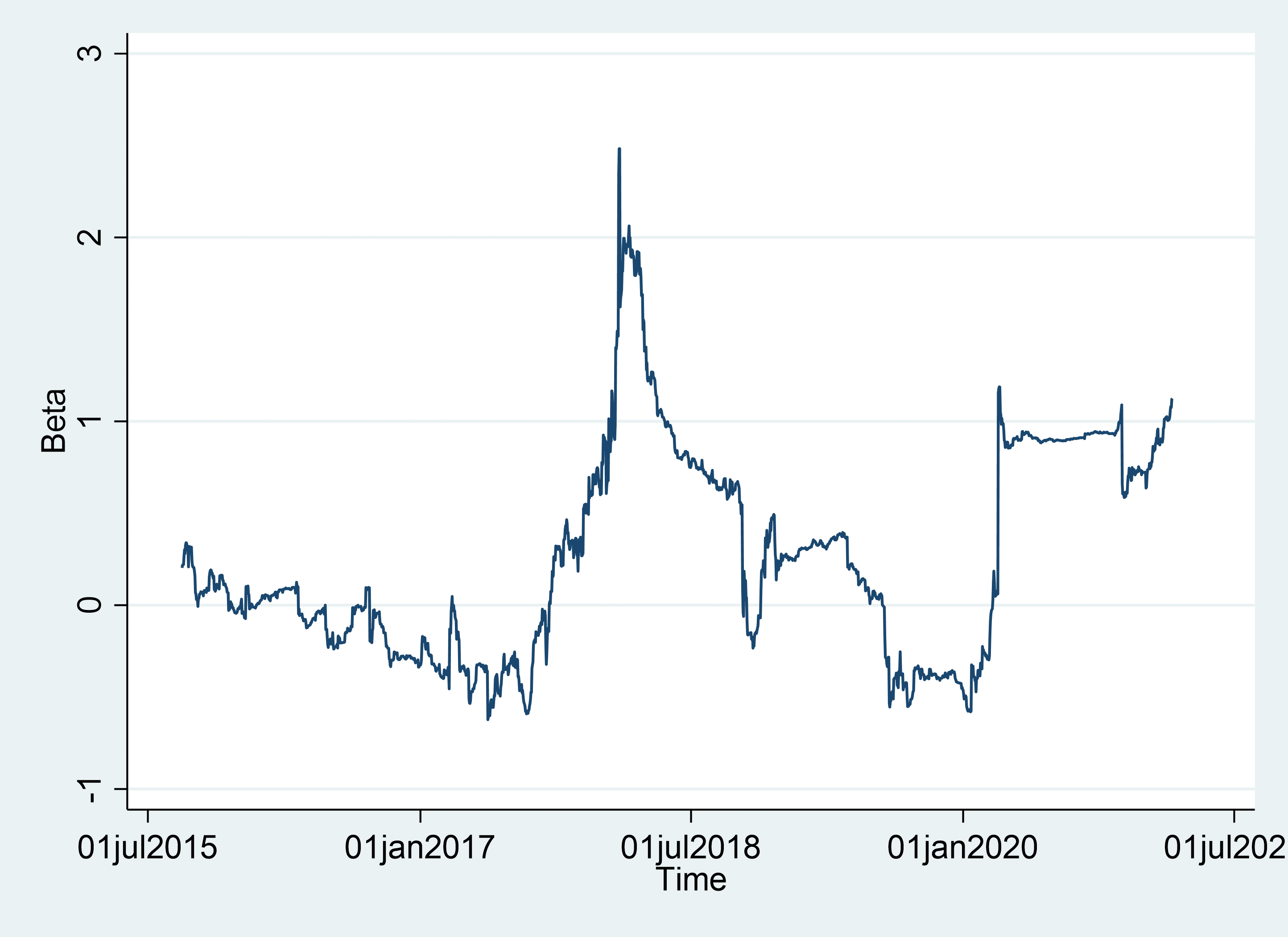

We can start with the β term. It tells us how sensitive and responsive Bitcoin’s movements are to movements on the market index. If β = 2, then a 1 per cent increase in the market index will manifest in a 2 per cent increase in bitcoin on average. To analyse β it is useful to run the aforementioned regression for a rolling 250-day period. That is, we estimate the regression using 250 days of stock returns, and update the regression every day. This gives us a time series of β coefficients.

Bitcoin’s β fluctuates significantly over time. Until 2020, bitcoin sometimes had a negative β and sometimes had a positive β. The average beta over the whole time series is 0.26 and the standard deviation is 0.56, suggesting significant volatility in the β. However, this appears to change significantly in 2020. Around March 2020, whereafter the β hovered near 1. Thus, from March 2020 onwards, Bitcoin’s diversification benefits significantly fell. The diversification benefits were not entirely eliminated, but they significantly reduced. Indeed, unless we expect either (a) Bitcoin to continue to offer supernormal returns and/or (b) Bitcoin’s beta to fall, Bitcoin’s diversification benefits could be in doubt.

The beta does not tell us the full story, however. If Bitcoin has a significant, then it would significantly outperform the market. However, the α must be treated with some caution as a significant α can also arise because the market index is too blunt a measure to capture Bitcoin’s risk exposure. Further, if the regression model has low explanatory power, it would also indicate that variation in bitcoin’s returns is poorly explained by variation in the market returns.

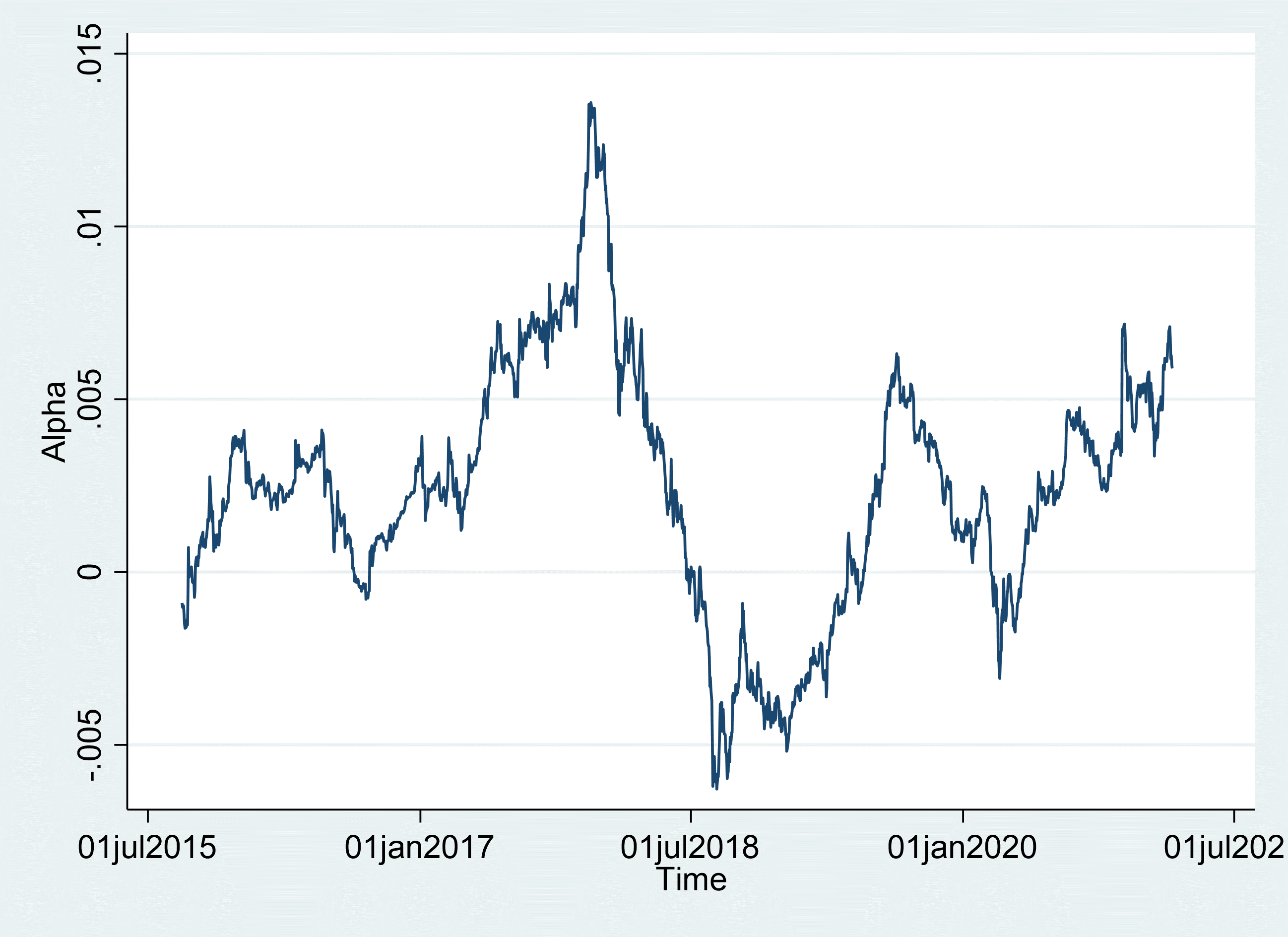

Bitcoin’s alpha fluctuates significantly over time. Bitcoin’s alpha is generally positive. Its statistical significance also varies over time. This suggests that for some, but not for all periods, Bitcoin outperforms the broader market.

The market explains a relatively small amount of Bitcoin’s price movements. The regression R-squared measures the proportion of the variation in Bitcoin’s price that is explained by market movements. Before 2018, the R-squared of the 250-day regression was low. Depending on the precise variables used, the R-squared was below 10 per cent. However, it increased to above 15 per cent in 2020. By contrast, the R-squared for a similar regression of Berkshire Hathaway in 2020 has an R-squared over 70 per cent.

The diversification benefits appear to be tangible, but difficult to quantify. The problem with Bitcoin is that its returns are extremely volatile. And, this creates model risk: it is very likely that any forward-looking estimates of Bitcoin’s returns or its risk will be incorrect. Both change significantly over time. Thus, past returns, and past asset allocations, are not necessarily representative of prospective returns and allocations.

Historical data shows that bitcoin could have given diversification benefits. If one had constructed a portfolio with both Bitcoin and the Market Index, then one could have achieved a better return per unit of risk than having merely one or the other. But, this is based on past data. This is not a good way to form a future-looking portfolio. Rather, one must base it on expected return, risk, and correlation.

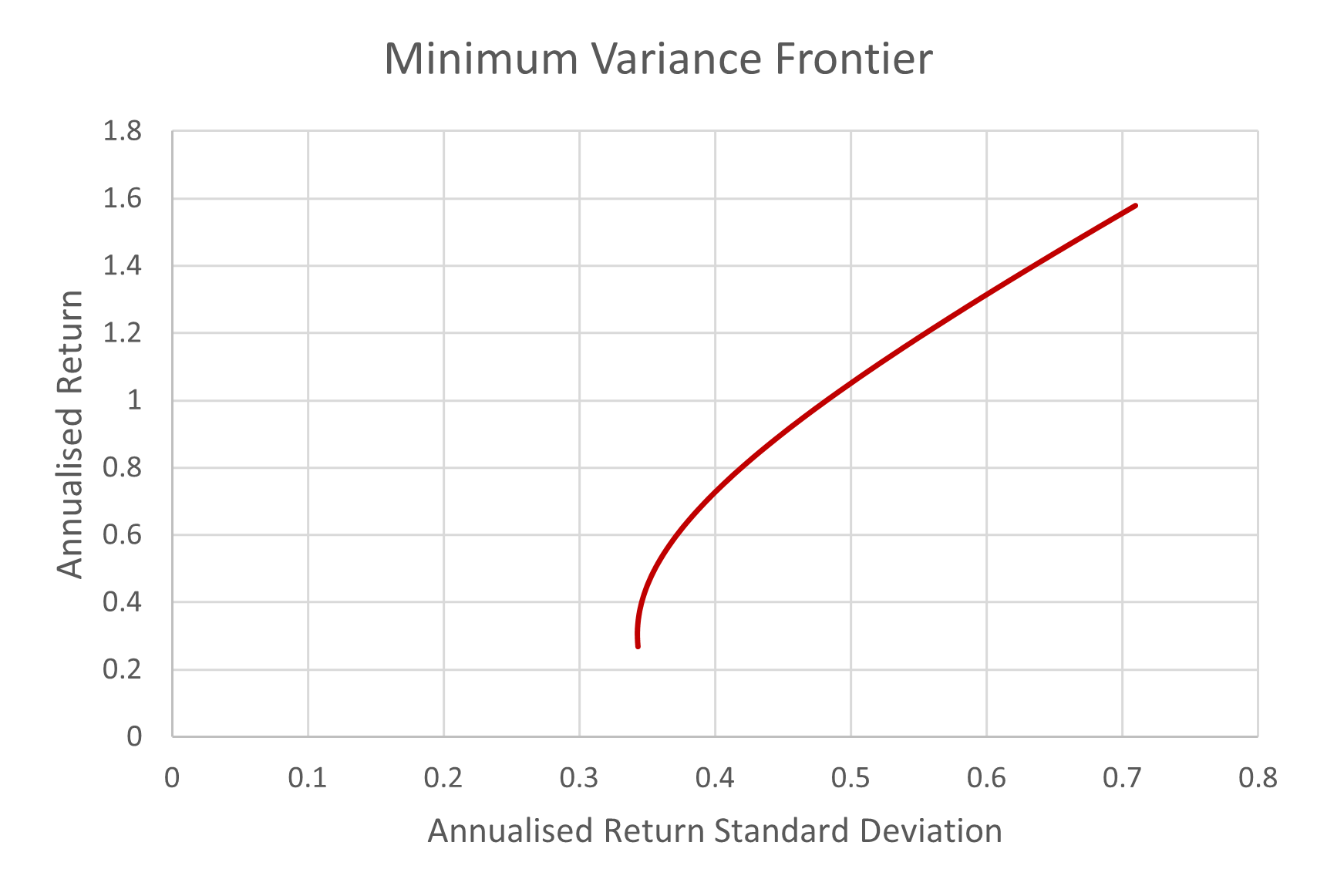

The optimal portfolio composition is unstable. The below minimum variance frontier plots the set of portfolios with the minimum variance for every level of return based on Bitcoin’s and the market’s return, risk, and correlation in 2020. It suggests diversification benefits. But, as indicated, these are unstable.

The investment frontier has significant limitations. The aforementioned frontier is based on past data. But all inputs: return, risk, and correlation are unstable. If Bitcoin started to generate negative returns, there would be no diversification benefit: Including bitcoin would reduce portfolio returns. If Bitcoin’s correlation increased, there would be less diversification benefit.

All asset allocation must be based on prospective inputs. As indicated, the aforementioned graph is based on historical data from 2020. For asset allocation, investors must use forward-looking inputs based on expected risk, return, and asset correlations. But, if one had perfect foresight, then diversification could have improved portfolio returns.

3. What does all this mean for investment?

The foregoing discussion indicates that Bitcoin might convey some diversification benefits. But, the extent of the benefit likely changes over time. Further, if one believes that Bitcoin’s expected return is negative, it might convey little benefit.

This implies that investors should do the following: First, investors must estimate Bitcoin’s expected risk, return, and its correlation with the market index. Second, if the expected return is positive, they must determine the appropriate amount of Bitcoin to add to a diversified portfolio. This amount could change over time and investors should continually monitor their asset allocation.

Mark Humphery-Jenner is an Associate Professor in the School of Banking & Finance at UNSW Business School. He has been published in leading management journals and his research interests include corporate finance, venture capital and law.