How Spotify is leading the music streaming revolution

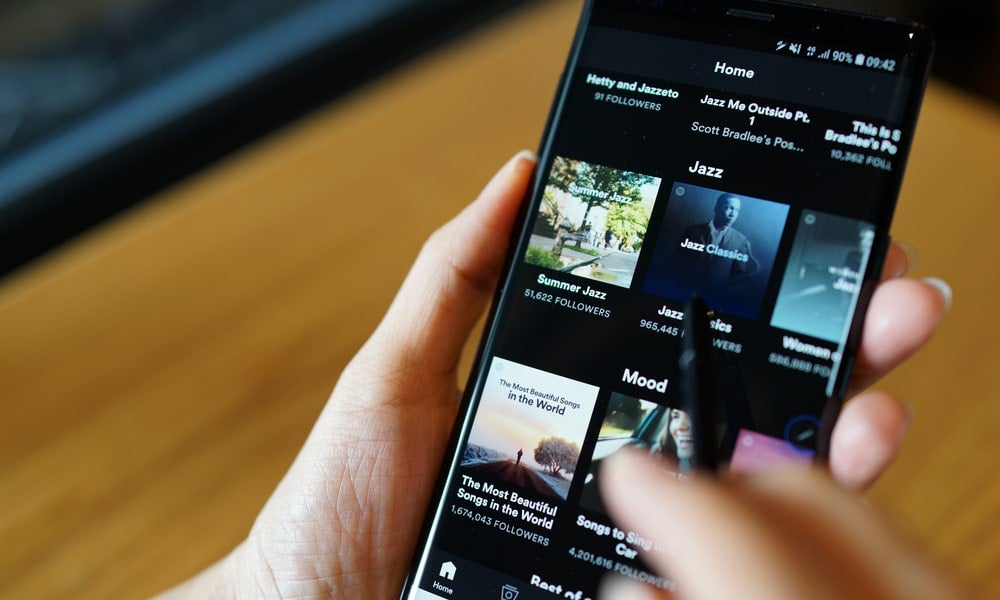

Spotify has become the world’s largest music streaming service thanks to innovative marketing and product launch strategies

This article is reprinted with permission from Perspectives@SMU, the public outreach journal of Singapore Management University which holds the copyright to this content.

In 2015, digital overtook physical formats as the biggest source of revenue for the music industry, according to the 2016 International Federation of the Phonographic Industry (IFPI) Global Music Report. Digital sales accounted for 45 per cent of industry revenues, compared with 39 per cent for physical sales.

Streaming revenue accounted for much of digital’s gains. Whereas downloads generated 10.5 per cent less revenue year-on-year to US$3 billion, streaming revenues jumped 45.2 per cent to US$2.9 billion and is poised to overtake downloads as the biggest growth engine for digital music consumption.

Spotify, with more than 40 million paid subscribers worldwide, is the world’s largest music streaming service, but the company remembers how it came into existence.

“The reason why we have music streaming today is because of piracy,” recalls Asad Kalimi, Spotify’s head of markets strategy and operation, Asia Pacific. “Spotify came out of Sweden, and Sweden and Norway were the two countries with the highest levels of piracy. In the early 2000s, the piracy level was at 90 per cent or more. Now, the piracy level is at less than 5 per cent.

“At the end of the day, the music industry as a whole – big labels included – still view piracy as our biggest threat. We all believe that the most effective way to draw music fans away from piracy is to give them exactly what they want – all the music at their fingertips. That’s been key to attracting millions of users and converting die-hard pirates to legal listeners,” Kalimi says.

Personalising preferences

Kalimi was speaking at the recent SMU Centre for Marketing Excellence speaker series event, Music & Millennials: The Art & Science behind Engaged Listeners. He elaborated on the ‘music for all’ approach and Spotify’s moves in personalising music recommendations for individual users.

“We acquired a company called The Echo Nest,” Kalimi says of the 2014 purchase of the music intelligence platform. “They tag every song with a lot of different attributes: tempo, volume, beat, rhythm, mood, as well as the genre [and so on]. The reason we acquired them is because we wanted to build that knowledge about every single user’s preferences.

“We then acquired another company called Seed Scientific [in 2015], and they were really good at building a platform to better understand how consumers, artists and brands interact with Spotify and with each other. That way, we can tell a singer who their fans are and which country they are based in: ‘Are you popular in one demographic in one country? Or are you popular in a certain genre in another country?’

“By acquiring these capabilities, we built what we called taste profiles for every single user. The more you listen to music on Spotify, the better your taste profile becomes. We know what kinds of music you like. That helped us improve your music experience.”

Read more: From audio apps to food delivery, picking winners in era of change

The Swedish company has since gone on an acquisition spree in 2016: Soundwave and Cord Project in January; CrowdAlbum in April; and in November, Preact, which Kalimi describes as “a cloud-based service that helps companies acquire new subscribers and retain current customers – specialising in predicting and informing consumer behaviour around subscription sign-ups and upgrades through advanced analytics, behavioural science and machine-learning techniques”.

The yuan, yen and beyond

Spotify’s recent spending suggests confidence in a growing pie: IFPI reported a 3.2 per cent increase in global music revenues (US$15 billion) for 2015 compared with 2014, fuelled largely by streaming and the spread of smartphones. The company has paid out more than US$1 billion in royalties in 2016, and more than five times that since coming into existence in 2008.

But for all its impressive numbers, Spotify is missing in potentially the biggest market of all (China), and was not in operation in another (Japan) until only weeks ago. “While Spotify’s long-term aim is to be available in every country, a lot of time and research goes into understanding each market before we can launch there,” Kalimi says. “We know just how passionate China’s music fans are, but we don’t have any immediate updates for now.”

He adds: “Localising our brand is a big part of our strategy. We don’t just want to launch Spotify in Indonesia; we want to launch Spotify Indonesia. We want to achieve localisation in its truest form by understanding how consumers consume music: the kinds of music they listen to; how they pay; [and] the kinds of advertising they are used to. In that vein, we would only launch in China when we truly believe that we have a good grasp of the cultural nuances of Chinese consumers and their market.”

With regard to Japan, Kalimi explains: “Japan is a hugely lucrative market for music and we understand that Japanese consumers prefer to buy their music physically, in the form of CDs, [rather] than digitally. Spotify views this as an opportunity rather than a threat as we believe that the way music is being heard has changed over the years, from vinyl to CDs to downloads and today, it is all about streaming.

“Entering Japan required a lot of effort from a localisation perspective. The local labels didn’t see much value in music streaming because it basically doesn’t exist in Japan. Convincing the labels that music streaming is the way of the future took a lot of time and effort. A Spotify team has been in Japan for four years but we only managed to launch this year.”

Music for all

Even as Spotify expands its reach, competition is keen. Its main competitor in the paid subscription space, Apple Music, continues to plug away. CNET reports similar user growth rates for both services but Apple Music’s smaller current paying user base of 16 million is a disadvantage compared with Spotify’s 40 million.

In response, Kalimi maintains that their biggest competitor is still piracy and that Spotify “welcomes any service that offers people the chance to listen to music safely and legally”.

Read more: Forming innovative and successful strategic alliances amid market uncertainty

Spotify also recently started streaming its first unofficial remix, the DJ Jazzy Jeff remix of Room in Here by American recording artist Anderson.Paak amid acquisition rumours of audio distribution platform SoundCloud. So what is Spotify’s strategy among the increasing competition? “In terms of Spotify’s strategy in this space, we believe that DJs who create music remixes participate in the music creation process and are thus artists themselves,” Kalimi says.

"Hence, these artists should be recognised and compensated as such. Our partnership with Dubset enables us to serve fans of dance music with the mixes they crave while ensuring that artists, labels and publishers get paid fairly – a win-win for music fans all over the world.

“Ultimately, big labels and small independent artists alike are happy because remixes of their music give music listeners fresh ways to listen and rediscover their work, which in turn boosts their own exposure. We believe that ‘music for all’ is the new reality of music distribution. Users now have an all-you-can-listen access to copious amounts of music whenever, wherever, instead of owning it.”